unfiled tax returns and stimulus check

If you are legally required to file taxes but havent for the past few years youll need to file at least your 2018 tax return. What to know when you file your 2020 tax return.

The IRS puts a limit on the time in which you can claim a refund for the over-payment of tax.

. There are even more consequences for individuals and business owners who fail file in the post-Coronavirus world of Coronavirus Stimulus checks. All the forms you need are included in one flat fee of 696 Euro. The CARES Act and payroll tax executive order are not the only help businesses are being given amid the COVID-19 pandemic.

We can help you file quickly for you to receive the Stimulus check as soon as possible. To amend a prior year return to claim any overpaid taxes you have three years from the date you filed it. Do you have unfiled tax years.

2 days agoTechnically the third stimulus check was an advance on the 2021 Recovery Rebate Credit credit even though it was based on the income and the number of dependents listed in your 2020 or 2019 tax. If you have not filed a 2018 or 2019 Federal tax return you will not receive a stimulus check. However you may need to jump through a few hoops first.

If you didnt file a tax return then you have two years to submit one in order to. Many thanks to Ideal Tax Solution for resolving my tax problems. If you havent already done so sign in to your TurboTax account and select the Take me to my return button.

If you have not filed your tax returns for 2018 and 2019 you will not receive a Coronavirus stimulus check. Find Out If You Qualify Today. IRS increasing focus on taxpayers who have not filed tax return.

In the coming week or so the IRS will first look at your 2019 return and if the 2019 is not filed then the IRS will look at your 2018 return. Unfiled Tax Returns Impact Stimulus Check Qualifications. To get the 1200 Stimulus Check single 2400 married couple and 500 per child your 2018 or 2019 tax return will have to be filed UNLESS your only income is Social SecurityDisabilitySSI or at poverty level 12000 or less in which you will get the 1200 check without filing a return.

Whether you get a stimulus check or not relies heavily on your taxes even if you dont file at all. Also known as the Section 199A deduction the initiative allows qualified companies to. You create BIG tax problems when you are one of the many IRS non-filers and have unfiled or delinquent tax returns dont submit your income tax returns with the IRS.

This is a legitimate company that I will recommend to anyone no matter what your tax situation is. The Internal Revenue Service announced it will visit more taxpayers who havent filed tax returns for prior years in an effort to increase tax compliance and further enforce the law. In the eyes of the IRS non-filers of taxes is a serious offense.

Most people are eligible to get a stimulus if they meet the required threshold. In addition the IRS is increasing the use of data analytics research and new compliance strategies including. For most of us filing our 2018 and 2019 returns is a good idea to see if we are eligible for a stimulus check.

You could have a backlog of unfiled tax returns on queue which youll need to do something about. Unfiled tax returns will also prevent the individual or business. To get the checks your income as a single person will have to be less.

To delete all your tax information from TurboTax follow these steps. If you have unfiled tax returns from previous years but file this year the IRS may delay paying your refund. If you do not file taxes or receive Social Security benefits you qualify for a Stimulus Check.

Youll need to file your taxes ASAP to be eligible for a check. Select Tax Notice IRS Audit IRS Fresh Start Unfiled Tax Returns Owe IRS Tax Lien Wage Garnishment Bank Levy Stimulus Check Tax Refund Need IRS Hardship IRS Payment Plan. What do you need help with.

The 2020 Stimulus Check and Unfiled Tax Returns. Stimulus Checks are Impacted by Unfiled Tax Returns. Additional consequences are now felt in the post-Coronavirus world of unfiled tax returns for individuals and businesses.

As an American expat or Green Card Holder living abroad if you forgot or didnt know you had to file US tax returns and the FBAR annually theres a tax amnesty solution for you. March 27 2020 Back Tax Relief Stimulus Check Unfiled Returns. As future Coronavirus Stimulus money becomes available if you.

Perks of Filing Unfiled Tax Returns at MyExpatTaxes. After the expiration of the three-year period the refund statute prevents the issuance of a refund check and the application of any credits including overpayments of estimated or withholding taxes to other tax years. It feels as though Ive been set free without all the fear and heaviness I was feeling.

The IRS launched a new tool for people to register for their stimulus checks on April 10 2020. Another tax-related initiative to be aware of for 2021 is the Qualified Business Income QBI deduction introduced in the Tax Cuts and Jobs Act TCJA in 2017. Step 1 of 3.

May cause you to have your stimulus check to be delayed until non filed taxes are filed. Additionally you will only qualify for a check if you filed a tax return for either 2018 or 2019. I was overjoyed when I received my letter from the IRS that they accepted my offer.

You may also have been exempt from filing unfiled tax returns in the past because your income did not qualify to file for tax returns you are eligible to receive payment. In cases where you consistently file late the IRS may also delay your refund if it decides to audit your return. This happens when the IRS believes that there may be taxes owed for previous tax years.

Theres been a lot of confusion about how people who dont file tax returns will get. You also must not be claimed as a dependent on another persons tax return if you are over the age of 16. Delay of Your Refund.

IRS FRESH START PROGRAM. A Form SSA-1099 Social Security Benefit Statement Form RRB-1099 or Social Security Equivalent Benefit Statement will also qualify you. On the welcome back screen in the left-side menu select Tax Tools and then Clear Start Over select the menu icon in the upper-left corner if you dont see this menu.

Checks that are going out this month are for amended and duplicate tax returns and represent less than 1 of all GSS payments. If you didnt receive a direct deposit payment by Nov. An original return claiming a refund must be filed within 3 years of its due date for a refund to be allowed in most instances.

REFUND UPDATEIRS says stimulus check mistakes are among reasons for tax refund delays Families that received the payments which started in July and ended in December can file for the remainder. Stimulus checks and your taxes. However you cant check if you have a refund due to you until you complete a tax return.

The Streamlined Procedure allows you to avoid tax penalties and fees and puts you back on. You can still get a stimulus check even with unfiled tax returns. Here at MyExpatTaxes we have a dedicated package especially for you.

This is one of the most affordable options for getting back on track with your US expat.

7 Common Irs Notices What You Need To Know

How To Fill Out A Fafsa Without A Tax Return H R Block

Unfiled Tax Returns Back Taxes Jacksonville Tax Attorney

Is It Illegal Not To File Your Taxes If So Why Taxrise Com

What To Do If You Receive A Missing Tax Return Notice From The Irs

Irs The Notices Will Stop But You Still Need To Pay Fingerlakes1 Com

Irs Mind Staff Author At Irs Mind

The Penalty Will Be Waived This Year For Any Taxpayer Who Paid At Least 80 Percent Of Their Total Tax Liability Du Estimated Tax Payments Tax Payment Nanny Tax

Irs Tries To Reassure Pandemic Panicked Taxpayers

Have Unfiled Tax Returns As A Us Expat Here S What To Do About It

Faqs On Tax Returns And The Coronavirus

Unfiled Past Due Tax Returns Faqs Irs Mind

How To File Back Taxes On F J M Q Visas Filing Prior Year Tax Returns

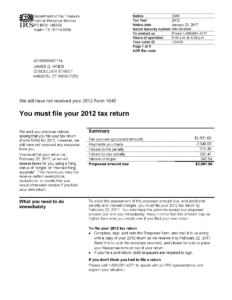

Irs Notice Cp2566 We Still Have Not Received Your Form 1040 H R Block

Irs Suspended Mailing Its Bad Notices For Now But You Can Still Be Penalized What To Know Reporterwings

Irs Notice Cp80 The Irs Hasn T Received Your Tax Return H R Block